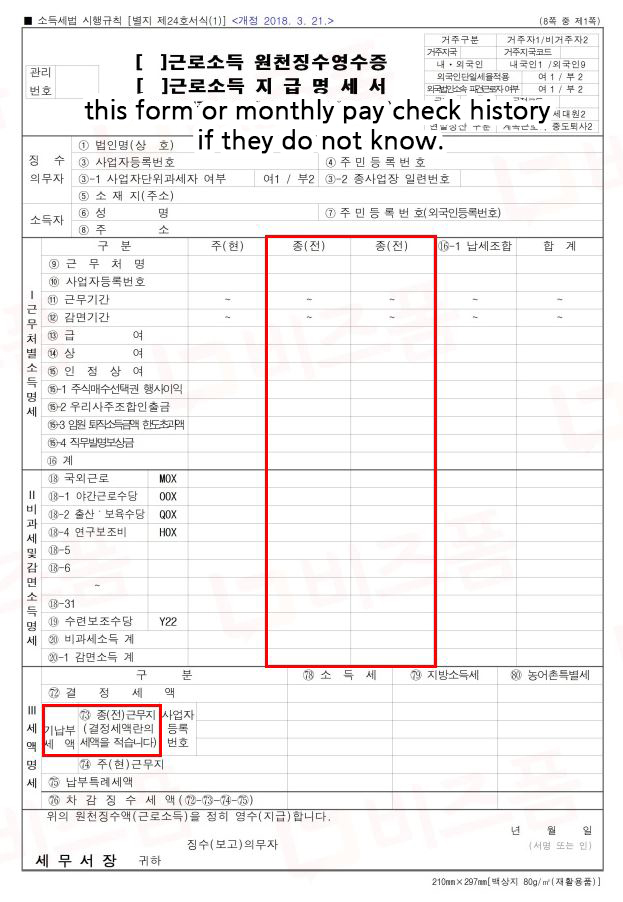

원천징수영수) Receipt of tax withheld, certification of Income

본문

This is needed to apply for your visa if you have ever worked in South Korea.

all employees need to prepare if you are planning to move the employer a receipt of tax withheld that you can get from your current school(근로소득원천징수영수증). if you have worked in South Korea over 1 year previously, you can print out the certification of Income(소득증명서) through the Home-tax website or get from the tax-office in your local.

please get this form by your ex or current employer at the end of the contract, before you leave, not too early.

When transferring jobs as an E-2 visa holder in South Korea, you may be required to provide certain documents, including a receipt of tax withheld and a certification of income, depending on the specific requirements of your new employer and the circumstances of your transfer. Here's some information regarding these documents in the context of job transfers:

Online tax portal: You can access the NTS's online tax portal, known as "Hometax," to view and download your tax-related documents. This platform allows you to access your tax records, including the tax withheld statement, once your employer has submitted the necessary information to the NTS. (ONLY if you have lived in Korea over 1 year)

1. Receipt of tax withheld: A receipt of tax withheld, which shows the amount of income tax deducted from your salary, may be requested by your new employer during the hiring or onboarding process. They may require this document to verify your employment history and to ensure compliance with tax obligations.

2. Certification of income: Similarly, a certification of income, which verifies your income details, may be required by your new employer. This document provides information about your previous salary, bonuses, deductions, and other relevant financial details.

3. Annual tax settlement process: In South Korea, employers are required to provide tax statements, including the tax withheld statement, to their employees during the annual tax settlement process. The settlement period typically occurs between February and March of the following year. Your employer should provide you with the necessary tax-related documents during this period.

These documents can serve as evidence of your previous employment and income, and they may be necessary for your new employer to process your employment and handle tax-related matters. It's advisable to request these documents from your current employer before leaving the position or to coordinate with them and your new employer to ensure a smooth transfer of necessary documentation.

all employees need to prepare if you are planning to move the employer a receipt of tax withheld that you can get from your current school(근로소득원천징수영수증). if you have worked in South Korea over 1 year previously, you can print out the certification of Income(소득증명서) through the Home-tax website or get from the tax-office in your local.

please get this form by your ex or current employer at the end of the contract, before you leave, not too early.

When transferring jobs as an E-2 visa holder in South Korea, you may be required to provide certain documents, including a receipt of tax withheld and a certification of income, depending on the specific requirements of your new employer and the circumstances of your transfer. Here's some information regarding these documents in the context of job transfers:

Online tax portal: You can access the NTS's online tax portal, known as "Hometax," to view and download your tax-related documents. This platform allows you to access your tax records, including the tax withheld statement, once your employer has submitted the necessary information to the NTS. (ONLY if you have lived in Korea over 1 year)

1. Receipt of tax withheld: A receipt of tax withheld, which shows the amount of income tax deducted from your salary, may be requested by your new employer during the hiring or onboarding process. They may require this document to verify your employment history and to ensure compliance with tax obligations.

2. Certification of income: Similarly, a certification of income, which verifies your income details, may be required by your new employer. This document provides information about your previous salary, bonuses, deductions, and other relevant financial details.

3. Annual tax settlement process: In South Korea, employers are required to provide tax statements, including the tax withheld statement, to their employees during the annual tax settlement process. The settlement period typically occurs between February and March of the following year. Your employer should provide you with the necessary tax-related documents during this period.

These documents can serve as evidence of your previous employment and income, and they may be necessary for your new employer to process your employment and handle tax-related matters. It's advisable to request these documents from your current employer before leaving the position or to coordinate with them and your new employer to ensure a smooth transfer of necessary documentation.